Plot expected and actual mean spending per transaction

Source:R/f_s3generics_clvfittedspending_plot.R

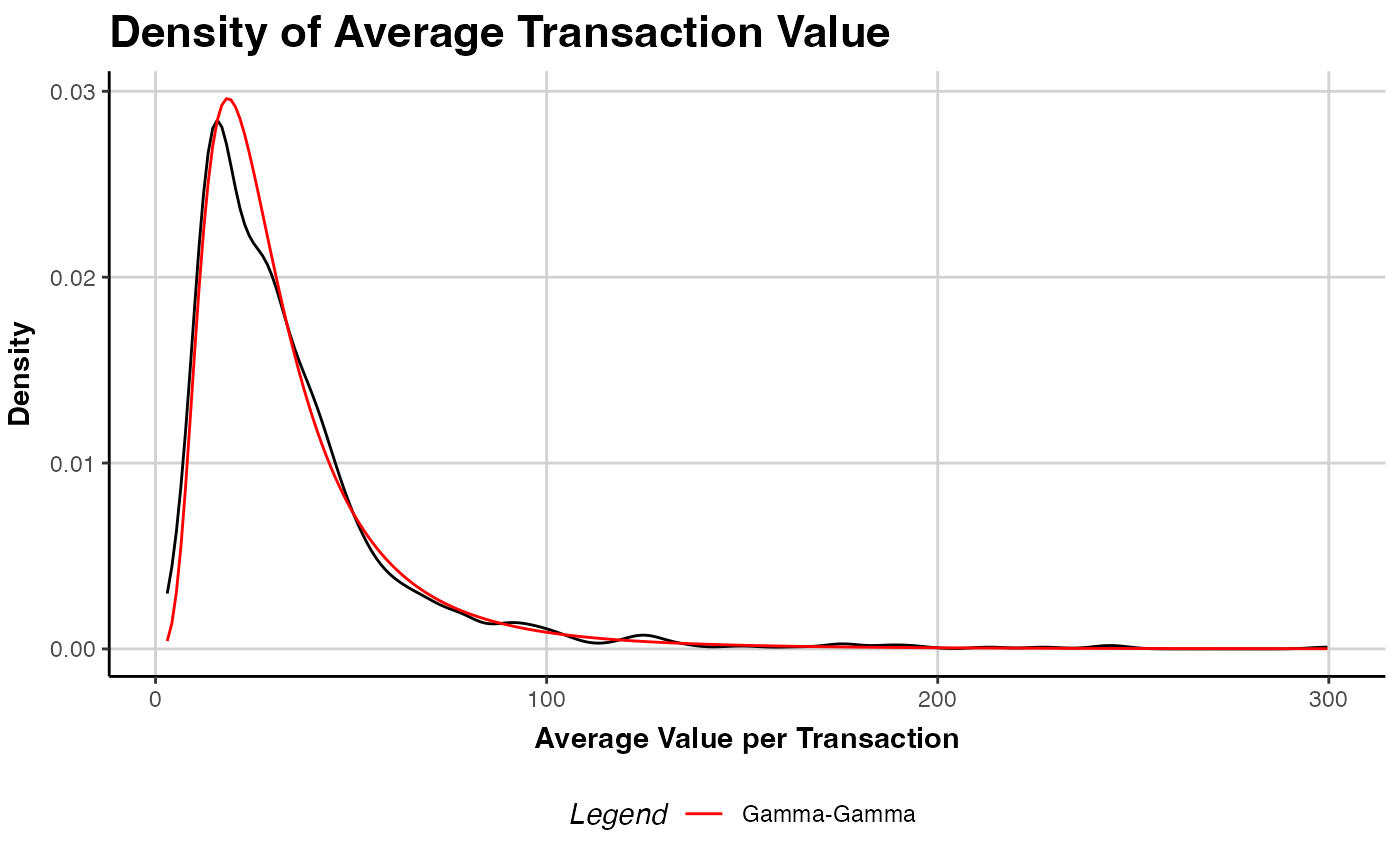

plot.clv.fitted.spending.RdCompares the density of the observed average spending per transaction (empirical distribution) to the

model's distribution of mean transaction spending (weighted by the actual number of transactions).

See plot.clv.data to plot more nuanced diagnostics for the transaction data only.

Arguments

Value

An object of class ggplot from package ggplot2 is returned by default.

References

Colombo R, Jiang W (1999). “A stochastic RFM model.” Journal of Interactive Marketing, 13(3), 2-12.

Fader PS, Hardie BG, Lee K (2005). “RFM and CLV: Using Iso-Value Curves for Customer Base Analysis.” Journal of Marketing Research, 42(4), 415-430.

Fader PS, Hardie BG (2013). “The Gamma-Gamma Model of Monetary Value.” URL http://www.brucehardie.com/notes/025/gamma_gamma.pdf.

Examples

# \donttest{

data("cdnow")

clv.cdnow <- clvdata(cdnow,

date.format="ymd",

time.unit = "week",

estimation.split = "1997-09-30")

est.gg <- gg(clv.data = clv.cdnow)

#> Starting estimation...

#> Estimation finished!

# Compare empirical to theoretical distribution

plot(est.gg)

if (FALSE) { # \dontrun{

# Modify the created plot further

library(ggplot2)

gg.cdnow <- plot(est.gg)

gg.cdnow + ggtitle("CDnow Spending Distribution")

} # }

# }

if (FALSE) { # \dontrun{

# Modify the created plot further

library(ggplot2)

gg.cdnow <- plot(est.gg)

gg.cdnow + ggtitle("CDnow Spending Distribution")

} # }

# }