Create an object for transactional data required to estimate CLV

Source:R/f_interface_clvdata.R

clvdata.RdCreates a data object that contains the prepared transaction data and that is used as input for model fitting. The transaction data may be split in an estimation and holdout sample if desired. The model then will only be fit on the estimation sample.

If covariates should be used when fitting a model, covariate data can be added to an object returned from this function.

clvdata(

data.transactions,

date.format,

time.unit,

estimation.split = NULL,

data.end = NULL,

name.id = "Id",

name.date = "Date",

name.price = "Price"

)Arguments

- data.transactions

Transaction data as

data.frameordata.table. See details.- date.format

Character string that indicates the format of the date variable in the data used. See details.

- time.unit

What time unit defines a period. May be abbreviated, capitalization is ignored. See details.

- estimation.split

Indicates the length of the estimation period. See details.

- data.end

The fictional end of the data, after the last recorded transaction in

data.transactions. See details.- name.id

Column name of the customer id in

data.transactions.- name.date

Column name of the transaction date in

data.transactions.- name.price

Column name of price in

data.transactions. NULL if no spending data is present.

Value

An object of class clv.data.

See the class definition clv.data

for more details about the returned object.

The function summary can be used to obtain and print a summary of the data.

The generic accessor function nobs is available to read out the number of customers.

Details

data.transactions A data.frame or data.table with customers' purchase history.

Every transaction record consists of a purchase date and a customer id.

Optionally, the price of the transaction may be included to also allow for prediction

of future customer spending.

time.unit The definition of a single period. Currently available are "hours", "days", "weeks", and "years".

May be abbreviated.

date.format A single format to use when parsing any date that is given as character input. This includes

the dates given in data.transaction, estimation.split, or as an input to any other function at

a later point, such as prediction.end in predict.

The function parse_date_time of package lubridate is used to parse inputs

and hence all formats it accepts in argument orders can be used. For example, a date of format "year-month-day"

(i.e., "2010-06-17") is indicated with "ymd". Other combinations such as "dmy", "dym",

"ymd HMS", or "HMS dmy" are possible as well.

data.end A point in time beyond the last purchase at which the data should fictionally end.

It defines the total time frame in which customers could be observed: The combined estimation and holdout periods.

For example, when the last recorded transaction was on "2000-12-29" but customers were actually observed until "2000-12-31".

Using data.end="2000-12-31" without holdout period,

the estimation period will be until "2000-12-31" and the prediction period will start on "2001-01-01".

Required to be after the last recorded transaction.

estimation.split May be specified as either the number of periods since the first transaction or the timepoint

(either as character, Date, or POSIXct) at which the estimation period ends.

Required to be before the last transaction.

The indicated timepoint itself will be part of the estimation sample.

If no value is provided or set to NULL, the whole dataset will used for fitting the model (no holdout sample).

Aggregation of Transactions

Multiple transactions by the same customer that occur on the minimally representable temporal resolution are aggregated to a

single transaction with their spending summed. For time units days and any other coarser Date-based

time units (i.e. weeks, years), this means that transactions on the same day are combined.

When using finer time units such as hours which are based on POSIXct, transactions on the same second are aggregated.

For the definition of repeat-purchases, combined transactions are viewed as a single transaction. Hence, repeat-transactions are determined from the aggregated transactions.

See also

SetStaticCovariates to add static covariates

SetDynamicCovariates for how to add dynamic covariates

plot to plot the repeat transactions

summary to summarize the transaction data

pnbd to fit Pareto/NBD models on a clv.data object

Examples

# \donttest{

data("cdnow")

# create clv data object with weekly periods

# and no splitting

clv.data.cdnow <- clvdata(data.transactions = cdnow,

date.format="ymd",

time.unit = "weeks")

# same but split after 37 periods

clv.data.cdnow <- clvdata(data.transactions = cdnow,

date.format="ymd",

time.unit = "w",

estimation.split = 37)

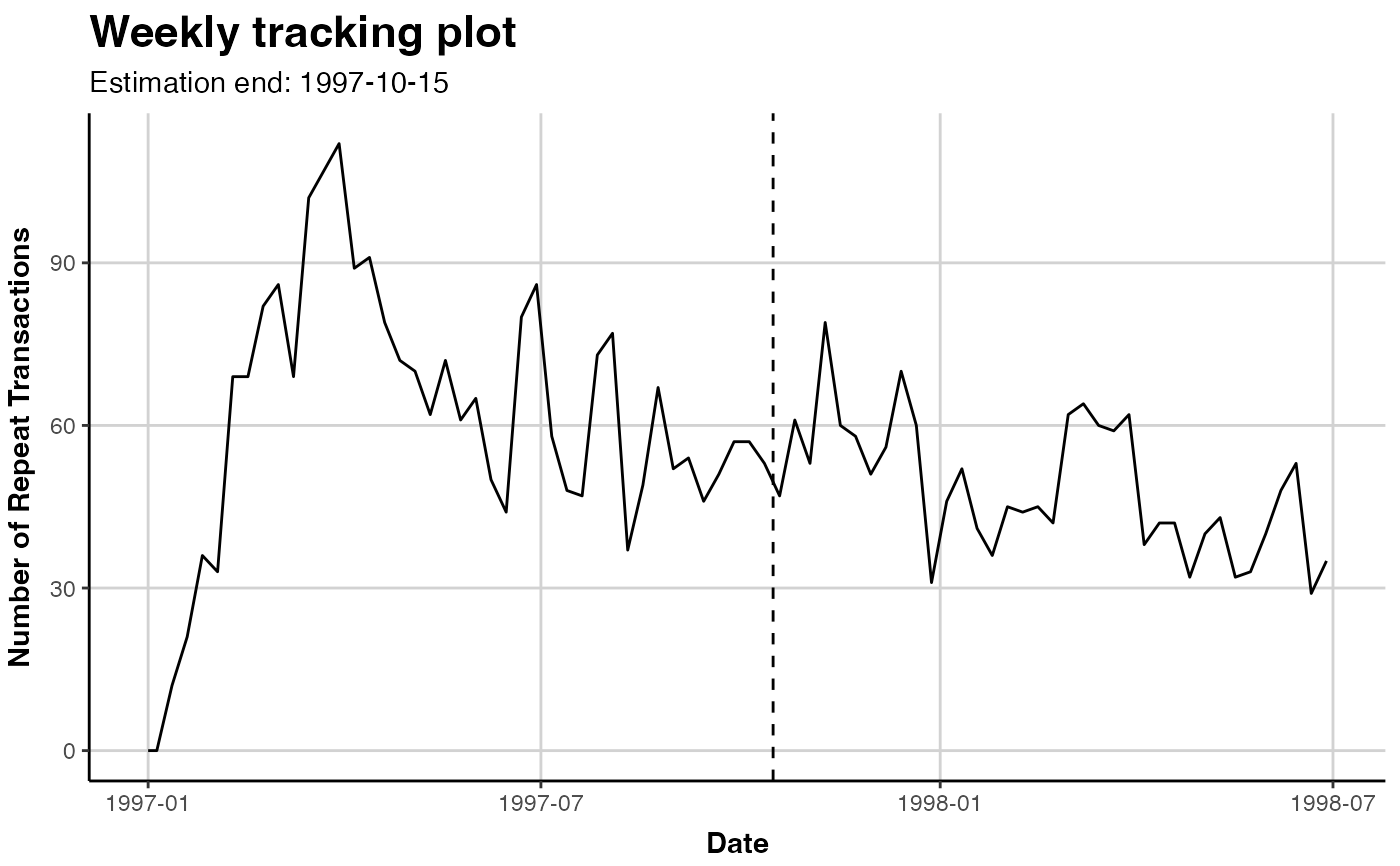

# same but estimation end on the 15th Oct 1997

clv.data.cdnow <- clvdata(data.transactions = cdnow,

date.format="ymd",

time.unit = "w",

estimation.split = "1997-10-15")

# Extend data fictionally until 31th Dec 1998

# In this case, this only moves the holdout period and has no effect on the

# estimation.

clv.data.cdnow <- clvdata(data.transactions = cdnow,

date.format="ymd",

time.unit = "w",

data.end = "1998-12-31",

estimation.split = "1997-10-15")

# summary of the transaction data

summary(clv.data.cdnow)

#> CLV Transaction Data

#>

#> Time unit Weeks

#> Estimation length 41.0000 Weeks

#> Holdout length 63.0000 Weeks

#>

#> Transaction Data Summary

#> Estimation Holdout Total

#> Period Start 1997-01-01 1997-10-16 1997-01-01

#> Period End 1997-10-15 1998-12-31 1998-12-31

#> Number of customers - - 2357

#> First Transaction in period 1997-01-01 1997-10-16 1997-01-01

#> Last Transaction in period 1997-10-15 1998-06-30 1998-06-30

#> Total # Transactions 4926 1770 6696

#> Mean # Transactions per cust 2.090 2.674 2.841

#> (SD) 2.275 2.892 3.772

#> Mean Spending per Transaction 35.917 37.946 36.453

#> (SD) 43.314 33.838 41.030

#> Total Spending 176928.390 67163.550 244091.940

#> Total # zero repeaters 1392 - -

#> Percentage of zero repeaters 59.058 - -

#> Mean Interpurchase time 9.738 7.996 16.017

#> (SD) 8.250 6.185 14.533

#>

# plot the total number of transactions per period

plot(clv.data.cdnow)

#> Plotting from 1997-01-01 until 1999-01-03.

#> Warning: A <numeric> value was passed to a Date scale.

#> ℹ The value was converted to a <Date> object.

if (FALSE) { # \dontrun{

# create data with the weekly periods defined to

# start on Mondays

# set start of week to Monday

oldopts <- options("lubridate.week.start"=1)

# create clv.data while Monday is the beginning of the week

clv.data.cdnow <- clvdata(data.transactions = cdnow,

date.format="ymd",

time.unit = "weeks")

# Dynamic covariates now have to be supplied for every Monday

# set week start to what it was before

options(oldopts)

} # }

# }

if (FALSE) { # \dontrun{

# create data with the weekly periods defined to

# start on Mondays

# set start of week to Monday

oldopts <- options("lubridate.week.start"=1)

# create clv.data while Monday is the beginning of the week

clv.data.cdnow <- clvdata(data.transactions = cdnow,

date.format="ymd",

time.unit = "weeks")

# Dynamic covariates now have to be supplied for every Monday

# set week start to what it was before

options(oldopts)

} # }

# }