Fits the Gamma-Gamma model on a given object of class clv.data to predict customers' mean

spending per transaction.

Arguments

- clv.data

The data object on which the model is fitted.

- start.params.model

Named start parameters containing the optimization start parameters for the model without covariates.

- remove.first.transaction

Whether customer's first transaction are removed. If

TRUEall zero-repeaters are excluded from model fitting.- optimx.args

Additional arguments to control the optimization which are forwarded to

optimx::optimx. If multiple optimization methods are specified, only the result of the last method is further processed.- verbose

Show details about the running of the function.

- ...

Ignored

Value

An object of class clv.gg is returned.

The function summary can be used to obtain and print a summary of the results.

The generic accessor functions coefficients, vcov, fitted,

logLik, AIC, BIC, and nobs are available.

Details

Model parameters for the G/G model are p, q, and gamma. p: shape parameter of the Gamma distribution of the spending process. q: shape parameter of the Gamma distribution to account for customer heterogeneity. gamma: scale parameter of the Gamma distribution to account for customer heterogeneity.

If no start parameters are given, p=0.5, q=15, gamma=2 is used for all model parameters. All parameters are required

to be > 0.

The Gamma-Gamma model cannot be estimated for data that contains negative prices. Customers with a mean spending of zero or a transaction count of zero are ignored during model fitting.

References

Colombo R, Jiang W (1999). “A stochastic RFM model.” Journal of Interactive Marketing, 13(3), 2-12.

Fader PS, Hardie BG, Lee K (2005). “RFM and CLV: Using Iso-Value Curves for Customer Base Analysis.” Journal of Marketing Research, 42(4), 415-430.

Fader PS, Hardie BG (2013). “The Gamma-Gamma Model of Monetary Value.” URL http://www.brucehardie.com/notes/025/gamma_gamma.pdf.

See also

Examples

# \donttest{

data("apparelTrans")

clv.data.apparel <- clvdata(apparelTrans, date.format = "ymd",

time.unit = "w", estimation.split = 52)

# Fit the gg model

gg(clv.data.apparel)

#> Starting estimation...

#> Estimation finished!

#> Gamma-Gamma Model

#>

#> Call:

#> gg(clv.data = clv.data.apparel)

#>

#> Coefficients:

#> p q gamma

#> 4.090 4.162 28.705

#> KKT1: TRUE

#> KKT2: TRUE

# Give initial guesses for the model parameters

gg(clv.data.apparel,

start.params.model = c(p=0.5, q=15, gamma=2))

#> Starting estimation...

#> Estimation finished!

#> Gamma-Gamma Model

#>

#> Call:

#> gg(clv.data = clv.data.apparel, start.params.model = c(p = 0.5,

#> q = 15, gamma = 2))

#>

#> Coefficients:

#> p q gamma

#> 4.090 4.163 28.707

#> KKT1: TRUE

#> KKT2: TRUE

# pass additional parameters to the optimizer (optimx)

# Use Nelder-Mead as optimization method and print

# detailed information about the optimization process

apparel.gg <- gg(clv.data.apparel,

optimx.args = list(method="Nelder-Mead",

control=list(trace=6)))

#> Starting estimation...

#> fn is fn1

#> Looking for method = Nelder-Mead

#> Methods to be used:[1] "Nelder-Mead"

#> optcfg:$fname

#> [1] "fn1"

#>

#> $npar

#> [1] 3

#>

#> $ctrl

#> $ctrl$follow.on

#> [1] FALSE

#>

#> $ctrl$save.failures

#> [1] TRUE

#>

#> $ctrl$trace

#> [1] 6

#>

#> $ctrl$kkt

#> [1] TRUE

#>

#> $ctrl$all.methods

#> [1] FALSE

#>

#> $ctrl$starttests

#> [1] FALSE

#>

#> $ctrl$maximize

#> [1] FALSE

#>

#> $ctrl$dowarn

#> [1] TRUE

#>

#> $ctrl$usenumDeriv

#> [1] FALSE

#>

#> $ctrl$kkttol

#> [1] 0.001

#>

#> $ctrl$kkt2tol

#> [1] 1e-06

#>

#> $ctrl$badval

#> [1] 8.988466e+307

#>

#> $ctrl$scaletol

#> [1] 3

#>

#> $ctrl$have.bounds

#> [1] FALSE

#>

#>

#> $usenumDeriv

#> [1] FALSE

#>

#> $ufn

#> function (par)

#> fn(par, ...)

#> <bytecode: 0x10cb449e0>

#> <environment: 0x11e4f7070>

#>

#> $have.bounds

#> [1] FALSE

#>

#> $method

#> [1] "Nelder-Mead"

#>

#> Method: Nelder-Mead

#> Nelder-Mead direct search function minimizer

#> function value for initial parameters = 2320.550547

#> Scaled convergence tolerance is 3.45789e-05

#> Stepsize computed as 0.100000

#> BUILD 4 2413.593778 2287.962766

#> EXTENSION 6 2320.550547 2118.179626

#> LO-REDUCTION 8 2288.939380 2118.179626

#> EXTENSION 10 2287.962766 2006.752787

#> EXTENSION 12 2140.779908 1865.377077

#> LO-REDUCTION 14 2118.179626 1865.377077

#> EXTENSION 16 2006.752787 1816.029388

#> LO-REDUCTION 18 1879.017352 1814.392354

#> LO-REDUCTION 20 1865.377077 1811.105613

#> HI-REDUCTION 22 1816.724761 1811.105613

#> HI-REDUCTION 24 1816.029388 1810.011973

#> HI-REDUCTION 26 1814.392354 1810.011973

#> EXTENSION 28 1812.328256 1803.967207

#> EXTENSION 30 1811.105613 1797.448167

#> EXTENSION 32 1810.011973 1792.651448

#> EXTENSION 34 1803.967207 1771.069003

#> LO-REDUCTION 36 1797.448167 1771.069003

#> EXTENSION 38 1792.651448 1736.929680

#> EXTENSION 40 1774.316285 1696.379972

#> LO-REDUCTION 42 1771.069003 1696.379972

#> EXTENSION 44 1736.929680 1594.842593

#> LO-REDUCTION 46 1705.673499 1594.842593

#> EXTENSION 48 1696.379972 1543.163720

#> LO-REDUCTION 50 1648.521091 1543.163720

#> REFLECTION 52 1594.842593 1504.492492

#> HI-REDUCTION 54 1556.787712 1504.492492

#> LO-REDUCTION 56 1549.465591 1504.492492

#> LO-REDUCTION 58 1543.163720 1504.492492

#> LO-REDUCTION 60 1533.857044 1504.492492

#> LO-REDUCTION 62 1511.527117 1504.492492

#> LO-REDUCTION 64 1507.812361 1503.645411

#> HI-REDUCTION 66 1507.121621 1503.645411

#> HI-REDUCTION 68 1504.804163 1503.645411

#> LO-REDUCTION 70 1504.492492 1503.645411

#> HI-REDUCTION 72 1504.385094 1503.645411

#> HI-REDUCTION 74 1504.004887 1503.645411

#> LO-REDUCTION 76 1503.924113 1503.645411

#> LO-REDUCTION 78 1503.871791 1503.645411

#> REFLECTION 80 1503.733127 1503.580032

#> REFLECTION 82 1503.656945 1503.529114

#> HI-REDUCTION 84 1503.645411 1503.529114

#> EXTENSION 86 1503.580032 1503.317265

#> LO-REDUCTION 88 1503.574968 1503.317265

#> EXTENSION 90 1503.529114 1503.187812

#> EXTENSION 92 1503.446600 1502.825206

#> EXTENSION 94 1503.317265 1502.503977

#> EXTENSION 96 1503.187812 1501.883004

#> EXTENSION 98 1502.825206 1500.833335

#> LO-REDUCTION 100 1502.503977 1500.833335

#> EXTENSION 102 1501.883004 1498.679882

#> LO-REDUCTION 104 1500.908856 1498.679882

#> EXTENSION 106 1500.833335 1498.025422

#> HI-REDUCTION 108 1499.273672 1498.025422

#> LO-REDUCTION 110 1499.196113 1498.025422

#> EXTENSION 112 1498.679882 1496.488212

#> HI-REDUCTION 114 1498.282504 1496.488212

#> EXTENSION 116 1498.025422 1495.480929

#> EXTENSION 118 1497.727222 1494.028696

#> LO-REDUCTION 120 1496.488212 1494.028696

#> EXTENSION 122 1495.480929 1491.004905

#> LO-REDUCTION 124 1494.352549 1491.004905

#> LO-REDUCTION 126 1494.028696 1491.004905

#> REFLECTION 128 1491.568134 1490.419555

#> HI-REDUCTION 130 1491.448804 1490.419555

#> EXTENSION 132 1491.004905 1489.493080

#> LO-REDUCTION 134 1490.912176 1489.493080

#> LO-REDUCTION 136 1490.419555 1489.493080

#> REFLECTION 138 1489.737964 1489.433009

#> LO-REDUCTION 140 1489.547197 1489.387178

#> HI-REDUCTION 142 1489.493080 1489.326166

#> LO-REDUCTION 144 1489.433009 1489.315144

#> LO-REDUCTION 146 1489.387178 1489.315144

#> LO-REDUCTION 148 1489.326166 1489.294595

#> HI-REDUCTION 150 1489.319300 1489.294595

#> REFLECTION 152 1489.315144 1489.273802

#> HI-REDUCTION 154 1489.298973 1489.273802

#> REFLECTION 156 1489.294595 1489.273140

#> HI-REDUCTION 158 1489.283957 1489.273140

#> REFLECTION 160 1489.275274 1489.268652

#> HI-REDUCTION 162 1489.273802 1489.268652

#> REFLECTION 164 1489.273140 1489.267276

#> LO-REDUCTION 166 1489.270088 1489.267276

#> HI-REDUCTION 168 1489.268837 1489.267276

#> LO-REDUCTION 170 1489.268652 1489.267276

#> LO-REDUCTION 172 1489.267993 1489.267276

#> HI-REDUCTION 174 1489.267578 1489.267276

#> LO-REDUCTION 176 1489.267491 1489.267245

#> LO-REDUCTION 178 1489.267381 1489.267163

#> HI-REDUCTION 180 1489.267276 1489.267163

#> HI-REDUCTION 182 1489.267245 1489.267157

#> Exiting from Nelder Mead minimizer

#> 184 function evaluations used

#> Post processing for method Nelder-Mead

#> Successful convergence!

#> Compute Hessian approximation at finish of Nelder-Mead

#> Compute gradient approximation at finish of Nelder-Mead

#> Save results from method Nelder-Mead

#> $par

#> log.p log.q log.gamma

#> 1.409896 1.425674 3.355160

#>

#> $value

#> [1] 1489.267

#>

#> $message

#> NULL

#>

#> $convcode

#> [1] 0

#>

#> $fevals

#> function

#> 184

#>

#> $gevals

#> gradient

#> NA

#>

#> $nitns

#> [1] NA

#>

#> $kkt1

#> [1] TRUE

#>

#> $kkt2

#> [1] TRUE

#>

#> $xtimes

#> user.self

#> 0.015

#>

#> Assemble the answers

#> Estimation finished!

# estimated coefs

coef(apparel.gg)

#> p q gamma

#> 4.095528 4.160661 28.650189

# summary of the fitted model

summary(apparel.gg)

#> Gamma-Gamma Model

#>

#> Call:

#> gg(clv.data = clv.data.apparel, optimx.args = list(method = "Nelder-Mead",

#> control = list(trace = 6)))

#>

#> Fitting period:

#> Estimation start 2005-01-02

#> Estimation end 2006-01-01

#> Estimation length 52.0000 Weeks

#>

#> Coefficients:

#> Estimate Std. Error z-val Pr(>|z|)

#> p 4.0955 0.8965 NA NA

#> q 4.1607 0.5876 NA NA

#> gamma 28.6502 10.2912 NA NA

#>

#> Optimization info:

#> LL -1489.2672

#> AIC 2984.5343

#> BIC 2997.7251

#> KKT 1 TRUE

#> KKT 2 TRUE

#> fevals 184.0000

#> Method Nelder-Mead

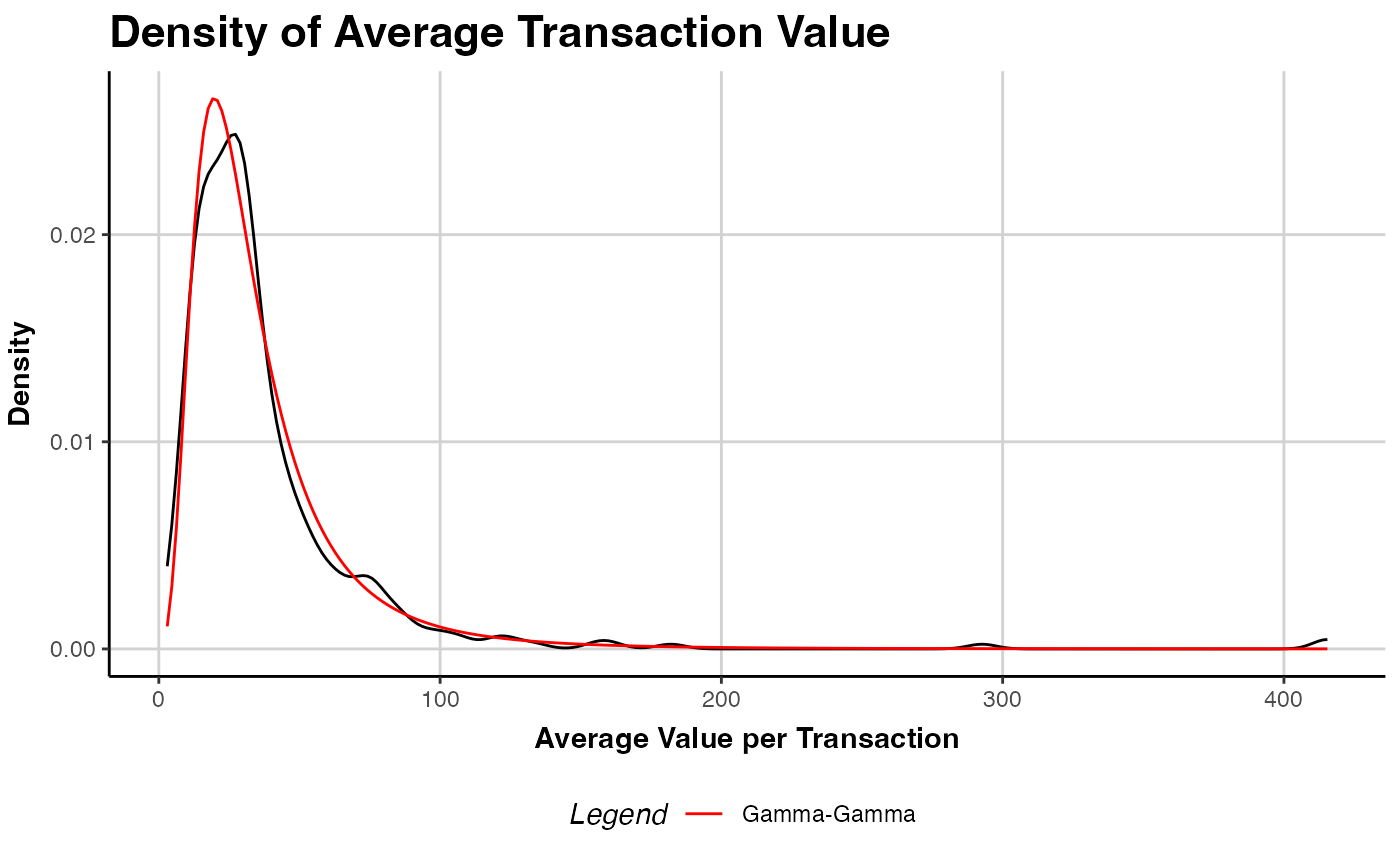

# Plot model vs empirical distribution

plot(apparel.gg)

# predict mean spending and compare against

# actuals in the holdout period

predict(apparel.gg)

#> Key: <Id>

#> Id actual.mean.spending predicted.mean.spending

#> <char> <num> <num>

#> 1: 1 104.82000 63.80198

#> 2: 10 31.65500 38.10401

#> 3: 100 37.03889 37.12440

#> 4: 101 0.00000 33.08068

#> 5: 102 0.00000 37.12440

#> ---

#> 596: 95 22.76000 28.28877

#> 597: 96 84.53667 37.12440

#> 598: 97 0.00000 37.12440

#> 599: 98 0.00000 34.87553

#> 600: 99 13.99000 16.10190

# }

# predict mean spending and compare against

# actuals in the holdout period

predict(apparel.gg)

#> Key: <Id>

#> Id actual.mean.spending predicted.mean.spending

#> <char> <num> <num>

#> 1: 1 104.82000 63.80198

#> 2: 10 31.65500 38.10401

#> 3: 100 37.03889 37.12440

#> 4: 101 0.00000 33.08068

#> 5: 102 0.00000 37.12440

#> ---

#> 596: 95 22.76000 28.28877

#> 597: 96 84.53667 37.12440

#> 598: 97 0.00000 37.12440

#> 599: 98 0.00000 34.87553

#> 600: 99 13.99000 16.10190

# }