CLVTools is a toolbox for various probabilistic customer attrition models for non-contractual settings. It provides a framework, which is capable of unifying different probabilistic customer attrition models. This package provides tools to estimate the number of future transactions of individual customers as well as the probability of customers being alive in future periods. Further, the average spending by customers can be estimated. Multiplying the future transactions conditional on being alive and the predicted individual spending per transaction results in an individual CLV value.

The implemented models require transactional data from non-contractual businesses (i.e. customers' purchase history).

See also

Development for CLVTools can be followed via the GitHub repository at https://github.com/bachmannpatrick/CLVTools.

Examples

# \donttest{

data("cdnow")

# Create a CLV data object, split data in estimation and holdout sample

clv.data.cdnow <- clvdata(data.transactions = cdnow, date.format = "ymd",

time.unit = "week", estimation.split = 39, name.id = "Id")

# summary of data

summary(clv.data.cdnow)

#> CLV Transaction Data

#>

#> Time unit Weeks

#> Estimation length 39.0000 Weeks

#> Holdout length 38.71429 Weeks

#>

#> Transaction Data Summary

#> Estimation Holdout Total

#> Period Start 1997-01-01 1997-10-02 1997-01-01

#> Period End 1997-10-01 1998-06-30 1998-06-30

#> Number of customers - - 2357

#> First Transaction in period 1997-01-01 1997-10-02 1997-01-01

#> Last Transaction in period 1997-10-01 1998-06-30 1998-06-30

#> Total # Transactions 4819 1877 6696

#> Mean # Transactions per cust 2.045 2.752 2.841

#> (SD) 2.195 3.026 3.772

#> Mean Spending per Transaction 35.962 37.715 36.453

#> (SD) 43.538 33.725 41.030

#> Total Spending 173300.400 70791.540 244091.940

#> Total # zero repeaters 1411 - -

#> Percentage of zero repeaters 59.864 - -

#> Mean Interpurchase time 9.282 8.227 16.017

#> (SD) 7.772 6.256 14.533

#>

# Fit a PNBD model without covariates on the first 39 periods

pnbd.cdnow <- pnbd(clv.data.cdnow,

start.params.model = c(r=0.5, alpha=8, s=0.5, beta=10))

#> Starting estimation...

#> Estimation finished!

# inspect fit

summary(pnbd.cdnow)

#> Pareto/NBD Standard Model

#>

#> Call:

#> pnbd(clv.data = clv.data.cdnow, start.params.model = c(r = 0.5,

#> alpha = 8, s = 0.5, beta = 10))

#>

#> Fitting period:

#> Estimation start 1997-01-01

#> Estimation end 1997-10-01

#> Estimation length 39.0000 Weeks

#>

#> Coefficients:

#> Estimate Std. Error z-val Pr(>|z|)

#> r 0.55104 0.04733 NA NA

#> alpha 10.55523 0.83991 NA NA

#> s 0.62519 0.19889 NA NA

#> beta 12.25194 6.63250 NA NA

#>

#> Optimization info:

#> LL -9615.2415

#> AIC 19238.4830

#> BIC 19261.5436

#> KKT 1 TRUE

#> KKT 2 TRUE

#> fevals 19.0000

#> Method L-BFGS-B

#>

#> Used Options:

#> Correlation FALSE

# Predict 10 periods (weeks) ahead from estimation end

# and compare to actuals in this period

pred.out <- predict(pnbd.cdnow, prediction.end = 10)

#> Predicting from 1997-10-02 until (incl.) 1997-12-10 (10 Weeks).

#> Estimating gg model to predict spending...

#> Starting estimation...

#> Estimation finished!

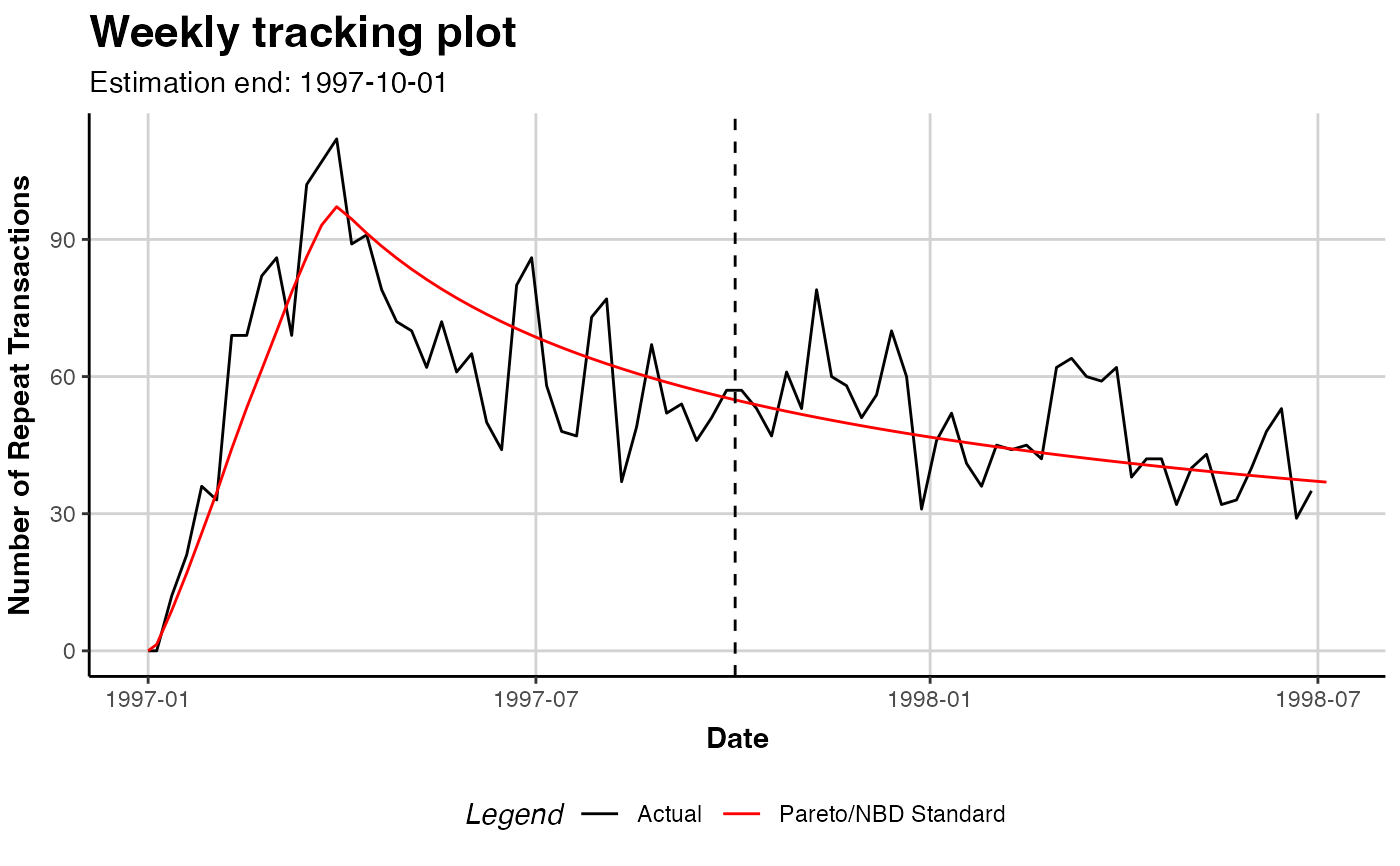

# Plot the fitted model to the actual repeat transactions

plot(pnbd.cdnow)

#> Plotting from 1997-01-01 until 1998-07-05.

#> Warning: A <numeric> value was passed to a Date scale.

#> ℹ The value was converted to a <Date> object.

# }

# }